Follow these control over their cash tips to better handle your hard earned dollars and eliminate bill getting to cover stress.

Start the entire process obtaining a notebook, monitoring the quantity and quantity of your expenses. I would suggest a general period of monthly.

Once you have collected four weeks price of expenses, ask them to organized into three posts. The initial will most likely be for your necessary products, the 2nd for products you do not actually need and may eliminate along with the third for products that could provide savings options by switching brands or companies.

This could include all bills, savings plans, investments and taxes. Getting collected everything should offer you a concept of the minimum you can survive. It will be the inspiration for almost any lean monthly budget.

Which makes it too strict will defeat the primary reason, since you won’t abide by it. You need to eliminate just as much waste as possible but have somewhat leeway. This can be done by offering your small monthly allowance to splurge on whatever you desire.

Based on your conditions and earnings begin with 25 or 50 dollars monthly. Next, enter smoking cigarettes of monitoring your own spending upon your allowance making corrections when needed. In case you consider its benefits, budgeting is most likely the treating of their cash tips too number of people take seriously.

Next, browse around you along with see what you are able reduce. For example:

Use a vehicle cover in situation your car is not parked in the spare room. You’ll safeguard it, not need vehicle washes as much and will not spend just as much on maintenance.

Let’s focus on control over their cash tips about your unnecessary spending habits: In the event you mind out two occasions every week?. Learn to prepare and you’ll save a good deal. Only a few new movie must be essential-see. Hold back until it comes down lower lower on DVD. Don’t stop doing everything, just choose a better (cheaper) method a number of things and limit your unnecessary outings.

Curtail any pricey hobbies for example snowboarding or golfing. You can begin by skipping almost every other trip. Not receiving a snowboarding pass could save you hundreds. You can set aside much more in case you leave the golf equipment within your house.

Too frequently, we splurge on obtaining the newest technologies. Including games, updated software, or even obtaining a completely new mobile phone every 6 a few days. Renting the sport or waiting six a few days to the completely new tech toy comes lower cost in rather than the final outcome all over the world. While using the quick advance in technology it’s virtually ruinous to help keep everything, filtration systems wait and skip almost every other upgrade? Pay lower debt while using the money you will save.

Among the finest steps you can take to spend less should be to quit smoking and consuming. It’s unhealthy and can result in huge future hospital bills.

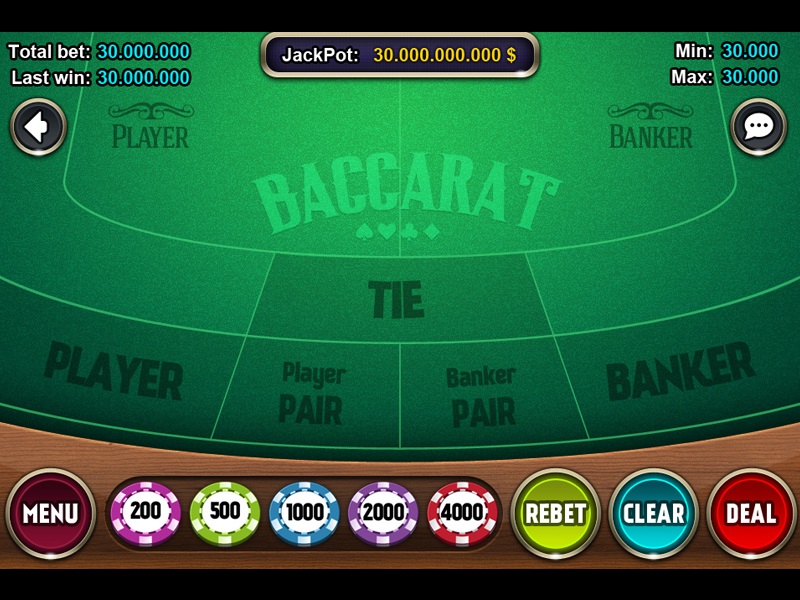

Another in the treating of their cash tips frequently overlooked should be to stop gambling. When you only spend 5 dollars every week round the lotto ticket, it comes down lower lower to 20 Dollars monthly or 240 dollars yearly. In addition any betting with buddies or on sporting occasions along with the cost might be substantial. An each week bingo habit will add up.